News & Views

Financial News

Apr 20 2012

Waters Corporation posted initial fourth quarter 2011 sales of $521 million, an increase of 8% from sales of $484 million in the fourth quarter of 2010. Earnings per diluted share (E.P.S.) were $1.51 compared to $1.36 for the fourth quarter of 2010. For the full year, sales for the Company were $1.85 billion, an increase of 13% over sales of $1.64 billion in 2010 with foreign currency translation adding about 3% to sales growth. E.P.S. for 2011 was $4.69 compared to $4.06 in 2010. Commenting on the Company’s 2011 performance, Douglas Berthiaume, Chairman, President and Chief Executive Officer said, “Our positive business momentum continued nicely in the fourth quarter with relatively balanced strength highlighting the results. The fourth quarter completed a very successful 2011 for Waters with double-digit revenue growth, faster earnings growth and very impressive cash generation.”

Thermo Fisher Scientific reported record fourth quarter results ending December 2011 that saw adjusted earnings per share (EPS) rise 23% to $1.18 and full year EPS figures reflecting 20% growth to $4.16. Revenues in Q4 also increased 15% to a record $3.13 billion. New products were launched in mass spectrometry, speciality diagnostics and laboratory equipment, with the addition of Dionex and Phadia also strengthening chromatography and immunodiagnostic market positions. Increased revenues in Highgrowth Asia-Pac markets revenues rose from 13% a year ago to 15% for 2011. Marc N. Casper, President and CEO of Thermo Fisher Scientific, said: “Our commitment to innovation drove significant product launches this year across all three business segments, and our expansion in high-growth emerging markets led to strong double-digit performance in China, India and Brazil.” He expressed confidence in share gain initiatives launched in the second half of the year and the continued to deploy capital to buy

back shares, spending a total of $1.3 billion in 2011.

Carl Zeiss announced increased revenue and earnings for fiscal year end (report: September 2011) with total revenue of €4.237 billion compared to €2.981 billion a year prior. Earnings (EbIT) totalled €607million, up on the €423 million posted in the same period 2010. Business was sustained by strong organic growth in revenue particularly in Asia and America ; also in the Industrial Metrology, Semiconductor Manufacturing Technology and Medical Technology business groups and by the full consolidation of the Vision Care business group. “We have achieved record figures for almost all performance indicators,” said Michael Kaschke, President and CEO of Carl Zeiss. “Carl Zeiss has remained on track to continued profitable and sustained growth and has further consolidated its position as a technology leader

and global player.”

OctoPlus NV reflected on 2011 as ‘a challenging year’ in its unaudited annual results to December 31; however, despite a drop in revenue to €7.7 million from €8.3 million in 2010 the company remained confident for its prospects in 2012. This was largely due to the ‘signing of a significant number of new contracts’ in November and December. “The impact on the 2011 revenues of these new signatures is limited but we expect that these contracts will contribute

in a material way to our 2012 revenues, enabling a substantial growth in revenues during this period,” a pokesperson said.

Agilent Technologies Inc has reported revenues of $1.64 billion for the first fiscal quarter ended Jan 31, 2012, 8% above one year ago. First-quarter GAAP net income was $230 million, or $0.65 per share. Last year's first-quarter GAAP net income was $193 million, or $0.54 per share.

During the first quarter, Agilent had intangible amortisation of $27 million, transformational charges of $8 million, and acquisition and integration costs of $7 million. The company also recognised a tax benefit of $24 million. Excluding these items and $4 million of other net benefits, Agilent reported first-quarter adjusted net income of $244 million, or $0.69 per share.

Bill Sullivan, Agilent President and CEO, said, "First-quarter currency adjusted revenue was at the low end of our guidance. We delivered earnings at the high end of our guidance, reflecting the strength of our operating model."

Electronic Measurement first-quarter revenues were up 1% over the prior year, while orders were down 5% from the same period last year, when orders had seen an increased 24%. Solid growth in the Aerospace/Defense and Industrial markets was offset by weaker Communications demand. Chemical Analysis revenues were 14% above one year ago with orders up by 4%. Good growth continued across all end markets, particularly in environmental,

petrochemical and food markets. Life Sciences also progressed well with revenues also up by 14% over last year. Orders were up 5 % with growth led by strong performance in pharma/ biotech and applied markets. First-quarter ROIC was 23%. Agilent generated $150 million of cash from operations in the quarter and net cash at the end of the first quarter was $1.6 billion.

Looking ahead, Sullivan said, "As we manage through a soft first half of the year, we are well positioned to capitalise on what we believe will be a stronger second half." Fiscal second-quarter 2012 revenues are expected to be in the range of $1.70 billion to $1.72 billion. Fiscal second-quarter non-GAAP earnings are expected to be in the range of $0.71 to $0.73 per share in line with Agilent's operating model. Agilent now expects full fiscal-year 2012 revenue of $6.92 billion - $7.02 billion, reflecting current exchange rates, and a tightened range of non-GAAP earnings of $3.13 - $3.23 per share.

Digital Edition

Lab Asia 31.2 April 2024

April 2024

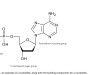

In This Edition Chromatography Articles - Approaches to troubleshooting an SPE method for the analysis of oligonucleotides (pt i) - High-precision liquid flow processes demand full fluidic c...

View all digital editions

Events

InformEx Zone at CPhl North America

May 07 2024 Pennsylvania, PA, USA

May 14 2024 Oklahoma City, OK, USA

May 15 2024 Birmingham, UK

May 21 2024 Lagos, Nigeria

May 22 2024 Basel, Switzerland

.jpg)